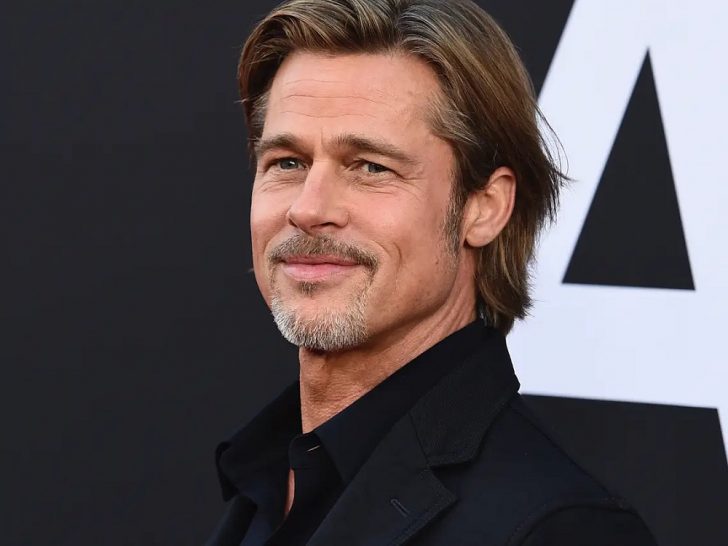

Brad Pitt, the renowned Oscar-winning actor behind iconic films like “Once Upon a Time in Hollywood” and “Fight Club,” is making headlines yet again, but this time it’s not for his on-screen charisma.

According to insider sources, he’s in the midst of a deal about to shake up the entertainment industry. Brad Pitt is selling a substantial 60% stake in his production company, Plan B Entertainment, to the French media powerhouse, Mediawan. While the official announcement is slated for this weekend, let’s delve into what we know.

A Strategic Move

Although the exact figures remain undisclosed, this intriguing deal has already been inked. However, insiders suggest it values Plan B Entertainment at a staggering sum in the hundreds of millions but falls just below the $500 million mark. As both parties, Plan B and Mediawan, have maintained tight lips regarding the agreement’s specifics, relying on these clandestine sources is essential for now.

The Genesis of Plan B

Founded in 2001, Plan B Entertainment is the brainchild of Brad Pitt, who ventured into this endeavor alongside his then-wife, Jennifer Aniston, and his then-manager, Brad Grey (who passed away in 2017). Following his divorce from Aniston, Pitt assumed sole ownership of the production company, steering it towards remarkable achievements.

A Legacy of Excellence

Over the past two decades, Plan B Entertainment has made an indelible mark in the film and television industry. The company boasts an impressive portfolio that includes Academy Award-winning gems like “The Departed” and “12 Years a Slave.”

Their recent works continue to captivate audiences, with projects such as “Blonde,” a fictionalized portrayal of Marilyn Monroe for Netflix, and “She Said,” a gripping narrative that delves into The New York Times’ investigation of sexual assault in Hollywood.

On television, Plan B has delivered compelling content like HBO’s critically acclaimed “The Normal Heart,” directed by Ryan Murphy, and Amazon Prime Video’s thought-provoking 2021 miniseries, “The Underground Railroad.”

The Streaming Revolution

In the ever-evolving media consumption landscape, independent production studios have become highly coveted assets for large media corporations aiming to expand their streaming services.

A prime example is Reese Witherspoon, who sold a majority stake in her company, Hello Sunshine, to Candle Media, founded by Disney veterans Kevin Mayer and Tom Staggs. This landmark deal valued Hello Sunshine at an impressive $900 million. Candle Media also recently acquired a minority stake in Westbrook Inc., founded by the dynamic duo of Will Smith and Jada Pinkett Smith.

Meet Mediawan

Mediawan, the French media conglomerate making waves with this acquisition, is a content studio producing various movies and TV series across Europe and the United States.

With ownership of more than 60 production labels, it’s clear that Mediawan has a firm grip on the entertainment landscape. The company was co-founded by Chairman Pierre Antoine-Capton, who is poised to steer the ship towards new horizons with the addition of Plan B Entertainment.

The Deal Makers

It takes seasoned professionals to navigate the complexities of a transaction of this magnitude. The boutique investment bank Moelis played a pivotal role in facilitating the sale on behalf of Plan B Entertainment. However, as is customary in such high-stakes negotiations, a spokesperson for Moelis has refrained from making any official comments.